The financial crime platform for global AI risk management

Unifying fraud prevention, AML compliance, and real-time transaction monitoring in one AI-powered platform trusted by banks, fintechs, and merchants.

PRODUCTS

Modular building blocks for managing risk across the customer journey

Powered by Sardine Agents for onboarding, sanctions screening, disputes, and beyond.

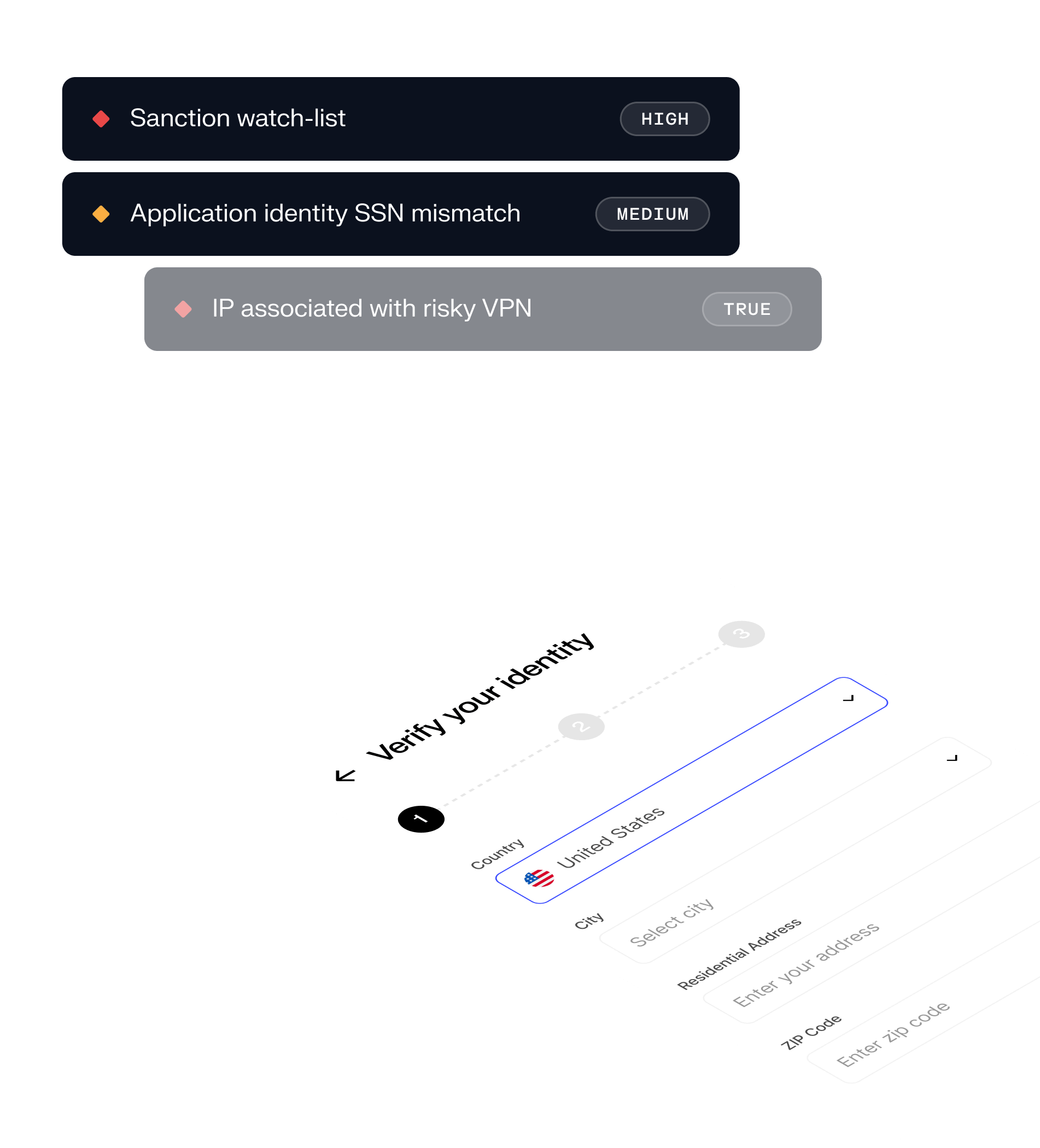

Verify consumers, businesses, and merchants instantly

Automate verification, risk scoring, and credit decisioning with our suite of onboarding agents.

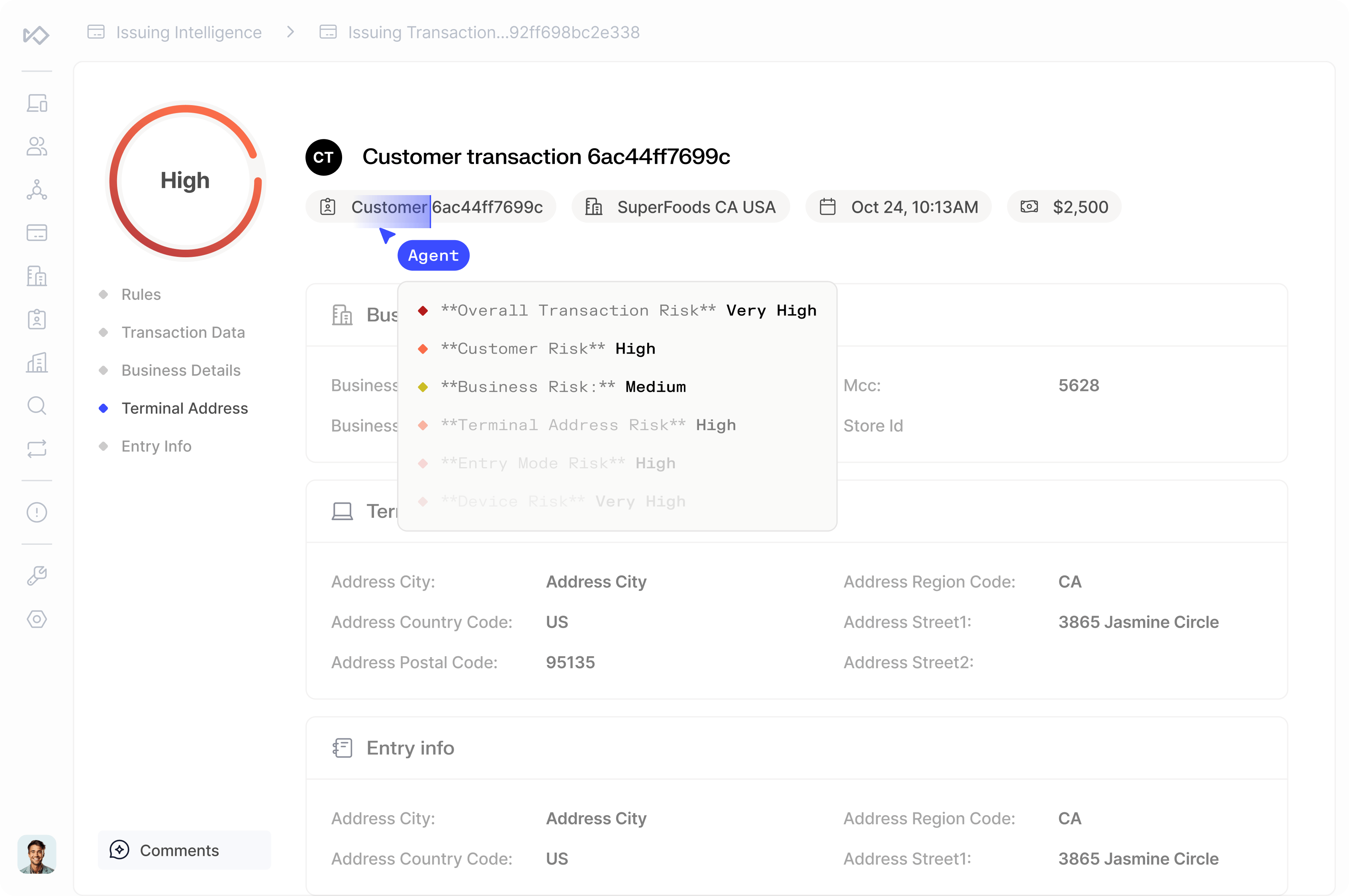

Catch fraud at login, checkout and everything in between

Sardine’s AI Agents don’t just flag issues. They triage alerts, open cases and route follow-ups automatically.

Spot suspicious behavior from the first click to the final step

Use device signals and behavioral biometrics to catch bad actors before they reach payments or onboarding.

Spot bots and account takeovers before money moves

Turn your data into a warning system that identifies high-risk users early without affecting legitimate ones.

Modernize your compliance operations

Get a clear view of customers and counterparties, alerts and an audit trail that stands up to scrutiny.

Make your risk team 10x more effective with Agentic AI

Reduce analyst time on level 1 work. Agents handle the first pass on alerts so your team can focus on high-risk investigations.

Why teams move their risk to Sardine

Fortune 500 companies have consolidated 11 risk vendors to 1. Find out why they chose Sardine.

See how Experian nam adipiscing non vel sed. Amet ut a porttitor vel velit cursus. Dui pretium aliquet.

PLATFORM

Built on the strongest risk data in the market and AI agents that actually act and adapt in real-time

Unified platform

Unify your risk workflow

Break down silos between fraud, AML, and credit teams with one connected platform.

Consortiums

Harness collective fraud intelligence

From onboarding to payments, cross-industry fraud intelligence gives you the shared context your internal rules alone cannot deliver.

Rules engine and machine learning

Turn insight into real-time action

Act instantly using rules, workflows, and ML models Sit at in morbi sed iaculis habitant. Quam mus sed

Connections Graph

Id lorem enim congue a vulputate

Imperdiet arcu sed adipiscing enim porta dignissim lorem. Id in sit vitae quam odio sit. Sit consectetur in morbi vitae elit eget urna.

A global leader in AI, fraud and compliance

enterprise customers

payments screened

devices profiled